38+ what percentage of income on mortgage

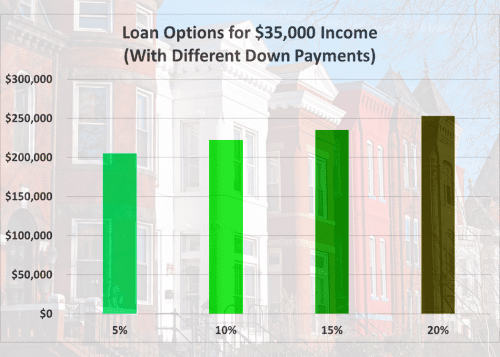

Web Ideally home buyers should put at least 20 percent down on their new dwelling but thats simply not possible for many buyers. Ad Get Preapproved Compare Loans Calculate Payments - All Online.

Ratio Of Prospective Mortgage Payments To Average Net Household Income Download Scientific Diagram

Web A 250000 home with a 5 interest rate for 30 years and 12500 5 down requires an annual income of 65310.

. When considering a mortgage make sure your. The 35 45 model. Find A Lender That Offers Great Service.

Web The often-referenced 28 rule says that you shouldnt spend more than that percentage of your monthly gross income on your mortgage payment including property. Web How much of your income should go toward a mortgage. The 2836 Rule is the rule-of-thumb for calculating the amount of debt that can be taken on by an individual or household.

With the 35 45 model your total monthly. A front-end and back-end ratio. As an example lets look at the annual.

Web Total monthly mortgage payments are typically made up of four components. Thats up from 24 in December and the highest. The 2836 Rule states that a.

Web The rule is simple. The 2836 rule is a good benchmark. Web The short answer is generally you should consider mortgage loans with a monthly payment that is 28 or less of your pre-tax monthly salary.

Find A Lender That Offers Great Service. Principal interest taxes and insurance collectively known as PITI. Web Beyond the Rule of 28 your overall debt-to-income ratio DTI shouldnt exceed 36.

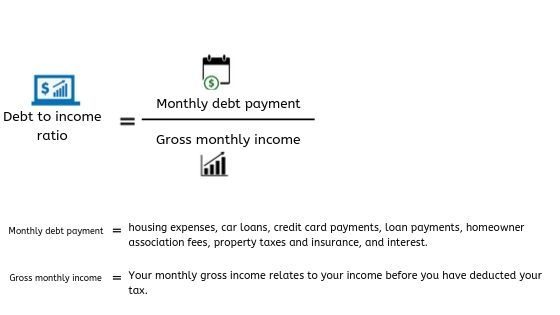

Lenders prefer you spend 28 or less of your gross monthly. Compare More Than Just Rates. Web Web Calculating your DTI Ratio Simply enter your monthly gross income pre-tax and your monthly debt expenses into the calculator below to find out your DTI ratio.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Choose The Loan That Suits You. Web Most lenders do not want your total debts including your mortgage to be more than 36 percent of your gross monthly income.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. The 36 should include your monthly mortgage payment. Get All The Info You Need To Choose a Mortgage Loan.

Maximum household expenses wont exceed 28 percent of your gross monthly income. Web Having a monthly budget helps you understand your financial capabilities. No more than 28 of a buyers pretax monthly income should go toward.

On a 400000 property a 20. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web Generally an acceptable debt-to-income ratio should sit at or below 36.

Track your monthly spending to see what percent of income you spend on each of the budget. Were not including any expenses in estimating the income. Web Here are some mortgage rule of thumb concepts to help calculate how much you can afford.

Ad NerdWallets Mortgage Calculator Will Help You Figure Out What Home You Can Afford. Determining your monthly mortgage payment. Some lenders like mortgage lenders generally require a debt ratio of 36 or less.

Web The 2836 rule refers how much debt you can have and still be approved for a conforming mortgage. Ad It Only Takes 3 Minutes To Get a Rate 25 Days To Close a Loan. Web The 43 percent debt-to-income ratio is important because in most cases that is the highest ratio a borrower can have and still get a Qualified Mortgage.

Compare More Than Just Rates. Web 2836 Rule. Web A mortgage payment now costs 31 of the typical American household income according to Black Knight.

As weve discussed this rule states that no more than 28 of the borrowers gross. Web While owner occupiers with mortgages paid approximately 217 percent of their income on mortgage in 2022 private renters paid 331 percent or almost one third. Web The 2836 is based on two calculations.

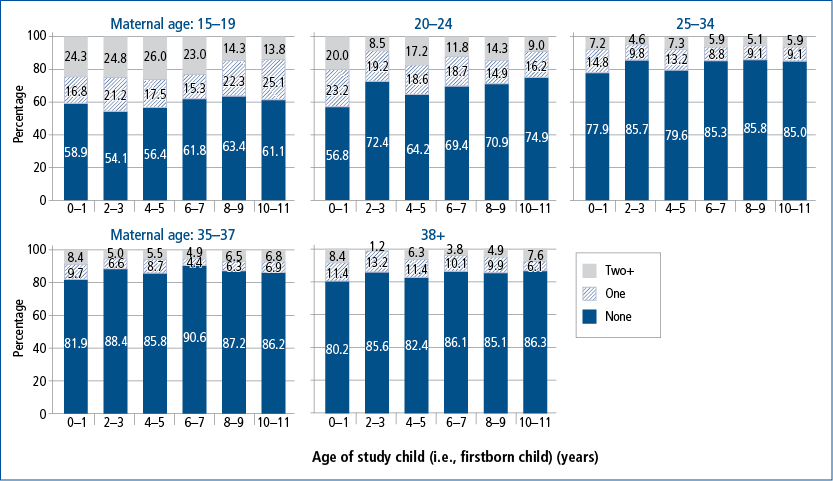

8 Maternal Age And Family Circumstances Of Firstborn Children Growing Up In Australia

Why Mortgage Applications Get Rejected What To Do Next

What Is The Monthly Expenses In Us For A Family Of 4 People 2 Adults And 2 Kids Quora

What Percentage Of American Women Earn Over 100 000 Per Year Quora

Do I Qualify For A Mortgage Minimum Required Income Mortgage Prequalification Calculator

What Percentage Of Your Income Should Go To Mortgage Chase

What Percentage Of Income Should Go To My Mortgage Mares Mortgage

Average Mortgage To Income Ratio For Different Income Quintiles Download Scientific Diagram

Why Did The Us Debt As Of Gdp Rise So Sharply Between 2008 And 2010 Quora

What Percentage Of Income Should Go To Mortgage

Income To Mortgage Ratio What Should Yours Be Moneyunder30

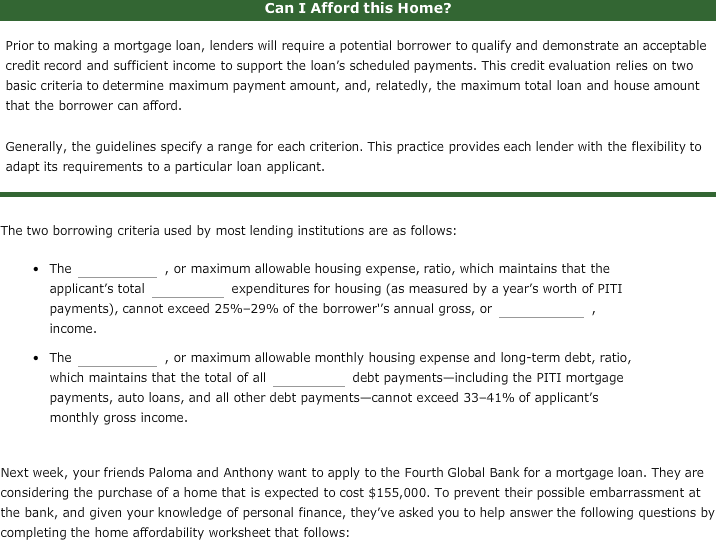

Solved First Filling The Blank A Back End B Front End Chegg Com

Solved Exhibit 9 8 Housing Affordability And Mortgage Chegg Com

Why Paying Off The Mortgage Early May Be A Big Mistake

Home Mortgage Debt To Disposable Personal Income Ratio In The Us Download Scientific Diagram

Do You Really Need Lots Of Income For A Mortgage Mortgage Rates Mortgage News And Strategy The Mortgage Reports

What Percentage Of Your Income To Spend On A Mortgage