5 401k match calculator

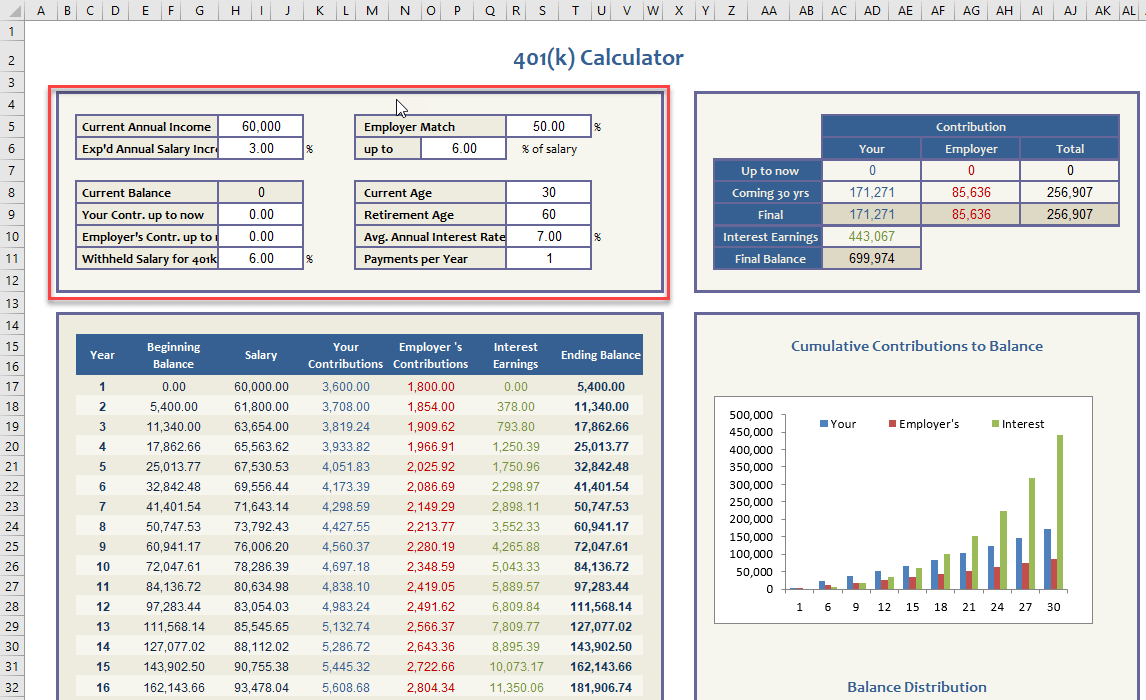

You expect your annual before-tax rate of return on your 401 k to be 5. This calculator assumes that your return is compounded annually and your deposits are made monthly.

What Is A 401 K Match Onplane Financial Advisors

Brought to you by Sapling.

. Dont Wait To Get Started. Ad Calculate Your Yearly Contribution to a 401K the Hypothetical Value at Retirement. Many employees are not taking full advantage of their employers matching contributions.

Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Apply your companys match percentage to your gross income for the contribution pay period. You only pay taxes on contributions and earnings when the money is withdrawn.

Step 6 Determine whether an employer is contributing to match the individuals contributionThat. Ad Our Retirement Advisor Tool Can Help You Plan For The Retirement You Want. However employees 50 and older can make an annual catch-up contribution of 6500 bringing their total limit to 27000.

Visit The Official Edward Jones Site. Hopefully you have more than this saved for. A 401 k account is an easy and effective way to save and earn tax deferred dollars for retirement.

Step 5 Determine whether the contributions are made at the start or the end of the period. Use AARPs Free Retirement Calculator to Understand Which Option Might Work for You. The actual rate of return is largely.

For example if your employer matches up to 3 percent. The employer match helps you accelerate your retirement contributions. Ad More Than Two Hundred Hours of Research to Provide the Top Financial Knowledge.

A 401 k can be one of your best tools for creating a secure retirement. The annual rate of return for your 401 k account. TIAA Can Help You Create A Retirement Plan For Your Future.

Compare 2022s Best Gold IRAs from Top Providers. According to research from Transamerica this is the median age at which Americans retire. As you enter the information in each of these categories you will finds that our 401k Retirement Calculator updates the figures and gives you a final figure as you press Calculate.

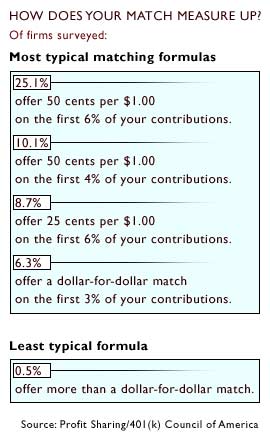

Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Current 401 k Balance. 050 per dollar on the first 6 of pay.

New Look At Your Financial Strategy. In the following boxes youll need to enter. Build Your Future With a Firm that has 85 Years of Investment Experience.

The annual elective deferral limit for a 401k plan in 2022 is 20500. Reviews Trusted by Over 45000000. New Look At Your Financial Strategy.

The benefit will be calculated as. Ad An Edward Jones Financial Advisor Can Partner Through Lifes MomentsGet Started Today. Your 401k plan account might be your best tool for creating a secure retirement.

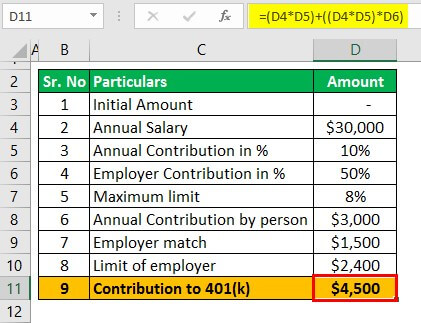

Ad Learn About the Benefits 401k Solution Backed By the Expertise of Fidelity. Pre-tax Contribution Limits 401k 403b and 457b plans. If the employee wants to withhold more than 4 percent of gross wages the benefit will match 50 percent up to 4 percent of the gross wages.

If for example your contribution percentage is so high that you obtain the 20500 year 2022 limit. Assume your employer offers a 100 match on all your contributions each year up to a maximum of 3 of your annual income. NerdWallets 401 k retirement calculator estimates what your 401 k balance will.

Your employer match is 100 up to a maximum of 4. How Matching Works. Visit The Official Edward Jones Site.

In this example you would enter 3. Your current before-tax 401 k plan. 100 per dollar on the first 3 of pay 050 per dollar on the next 2 of pay.

It provides you with two important advantages. First all contributions and earnings to your 401 k are tax deferred. For every dollar you contribute to your qualified retirement plan your employer will also make a contribution to your.

If you earn 60000.

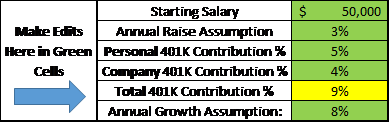

I Created A Little Calculator To Figure Out Exactly What My 401k Contribution Election Should Be To Front Load It Early Each Year Reach The Annual Max And Still Get The Full

This 401k Match Calculator Shows How Powerful Compound Interest Can Be

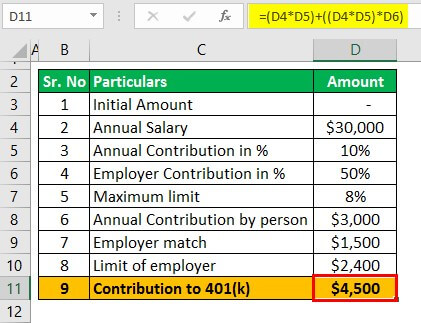

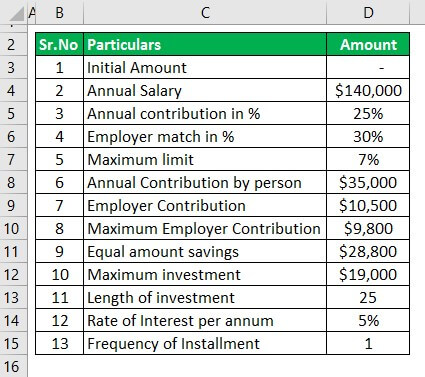

401k Contribution Calculator Step By Step Guide With Examples

The Maximum 401k Contribution Limit Financial Samurai

How Much Can I Contribute To My Self Employed 401k Plan

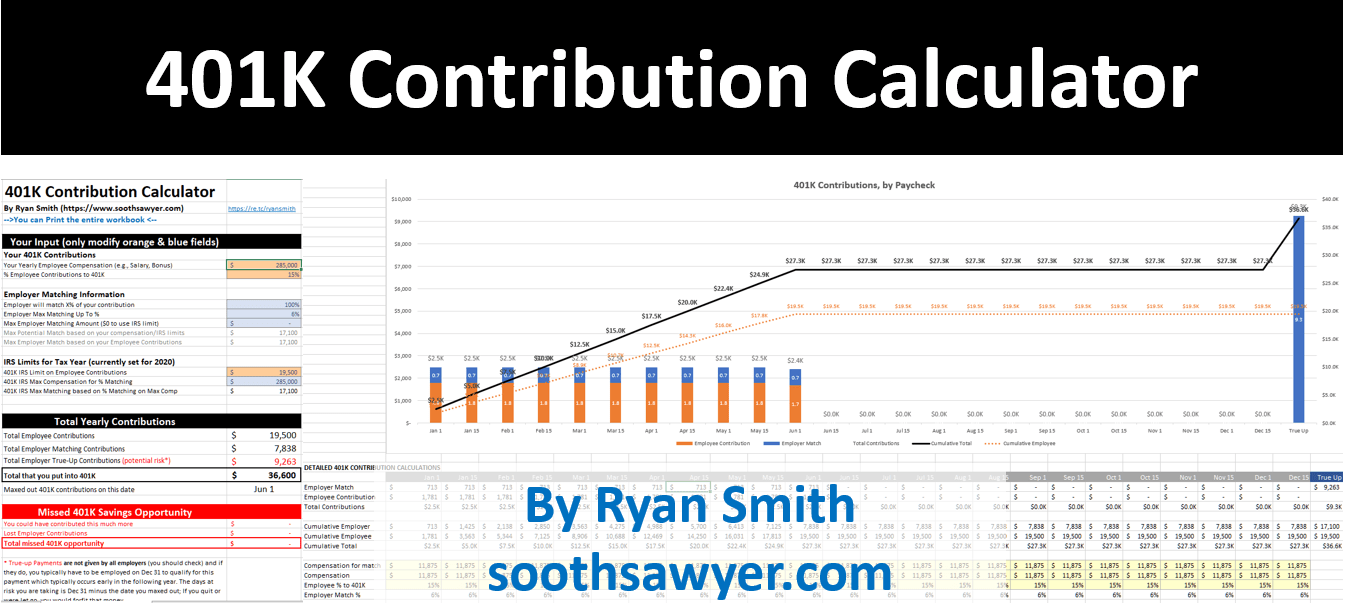

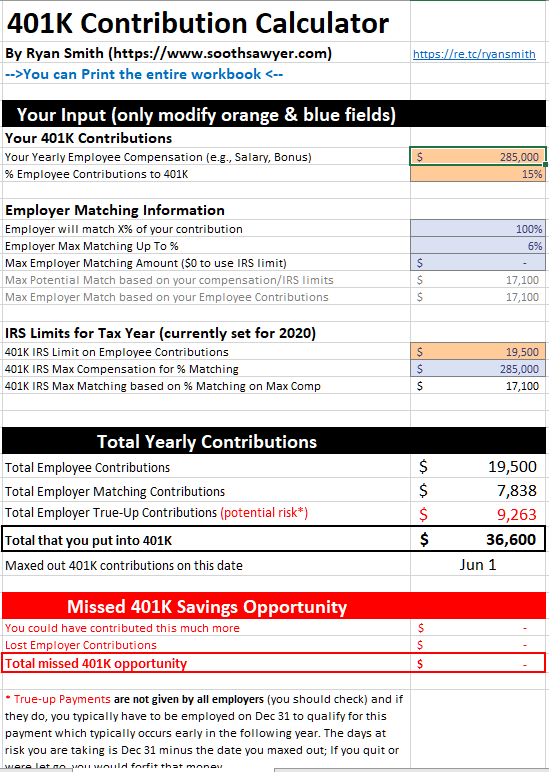

401k Employee Contribution Calculator Soothsawyer

Does Your Employer Penalize Aggressive Saving Odds Are Yes Resource Planning Group

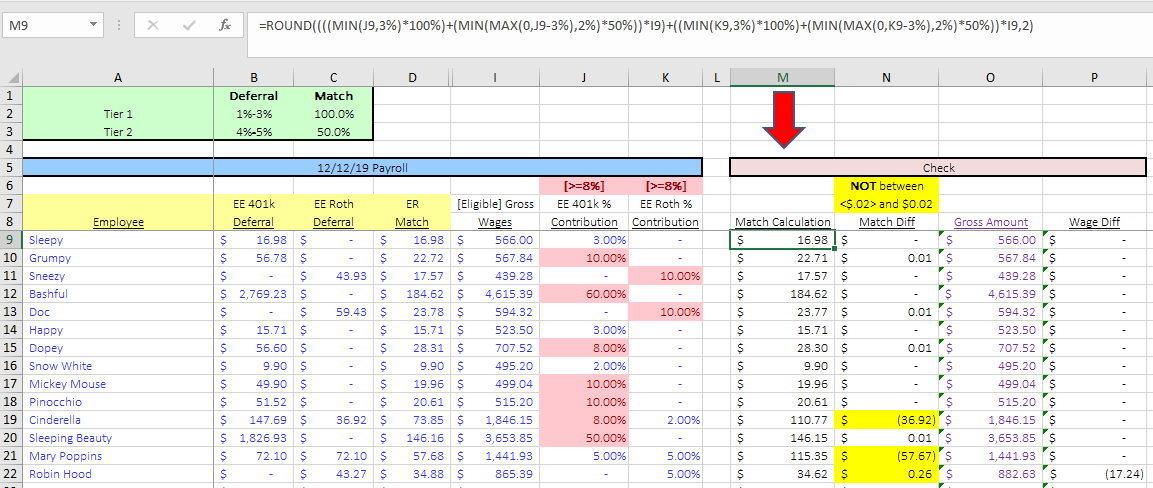

Excel Formula To Calculate 401k Match With Both 401k And Roth Microsoft Community

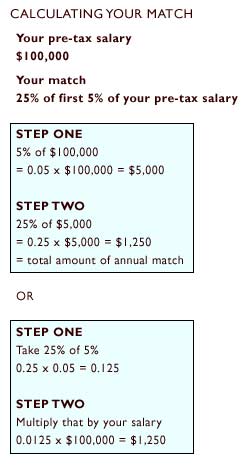

Doing The Math On Your 401 K Match Sep 29 2000

401k Employee Contribution Calculator Soothsawyer

401 K Plan What Is A 401 K And How Does It Work

Doing The Math On Your 401 K Match Sep 29 2000

Complex Formula Example 401k Match Youtube

Customizable 401k Calculator And Retirement Analysis Template

401k Contribution Calculator Amazon Com Appstore For Android

401k Contribution Calculator Step By Step Guide With Examples

Simplified Formula Example 401k Match Youtube